𝐓𝐡𝐞 𝐁𝐞𝐧𝐞𝐟𝐢𝐭𝐬 𝐨𝐟 𝐁𝐮𝐲𝐢𝐧𝐠 𝐯𝐬. 𝐑𝐞𝐧𝐭𝐢𝐧𝐠

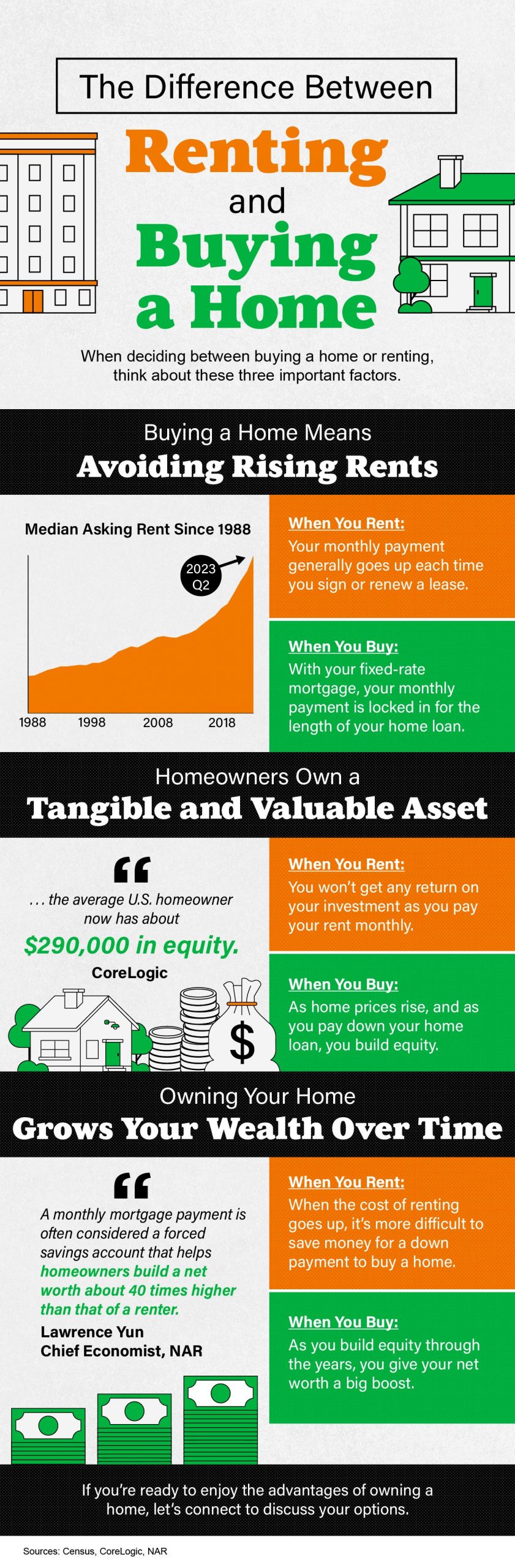

One of the most significant financial decisions in life is choosing between buying a home and renting. Each option has its pros and cons, but for many, the benefits of buying outweigh those of renting.

𝐁𝐮𝐢𝐥𝐝𝐢𝐧𝐠 𝐄𝐪𝐮𝐢𝐭𝐲 𝐎𝐯𝐞𝐫 𝐓𝐢𝐦𝐞

When you buy a home, you’re not just finding a place to live—you’re making an investment. Each mortgage payment you make contributes to building equity in your home. Over time, as your home hopefully appreciates in value, your equity grows even more. This is a form of forced savings that can serve you well in the long term. On the flip side, rent payments don’t contribute to any long-term ownership or financial gains.

𝐓𝐚𝐱 𝐀𝐝𝐯𝐚𝐧𝐭𝐚𝐠𝐞𝐬

Homeownership can also offer various tax benefits, such as the possibility to deduct mortgage interest and property taxes from your income tax. Depending on your specific circumstances, these deductions can make a significant difference in your annual tax liability. Renting does not offer these same financial advantages.

𝐆𝐫𝐞𝐚𝐭𝐞𝐫 𝐂𝐨𝐧𝐭𝐫𝐨𝐥 𝐚𝐧𝐝 𝐒𝐭𝐚𝐛𝐢𝐥𝐢𝐭𝐲

Owning a home gives you control over your living space. You can decorate, renovate, and even add to the property as you see fit. There’s also a level of stability that comes with homeownership; you don’t have to worry about a landlord raising your rent or selling the property out from under you.

𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭 𝐑𝐚𝐭𝐞𝐬: 𝐀 𝐂𝐥𝐨𝐬𝐞𝐫 𝐋𝐨𝐨𝐤

Now, let’s address the elephant in the room: interest rates. Sure, the idea of paying even an 8% interest rate on a mortgage might make you pause, especially when rates have been historically lower. But it’s essential to put this into perspective. When you’re renting, the money you pay each month essentially acts like a 100% interest rate; it doesn’t build equity or contribute to your future financial stability. So even if you’re looking at a higher interest rate for a mortgage, remember that part of that monthly payment goes toward owning a piece of property, not into a landlord’s pocket.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link