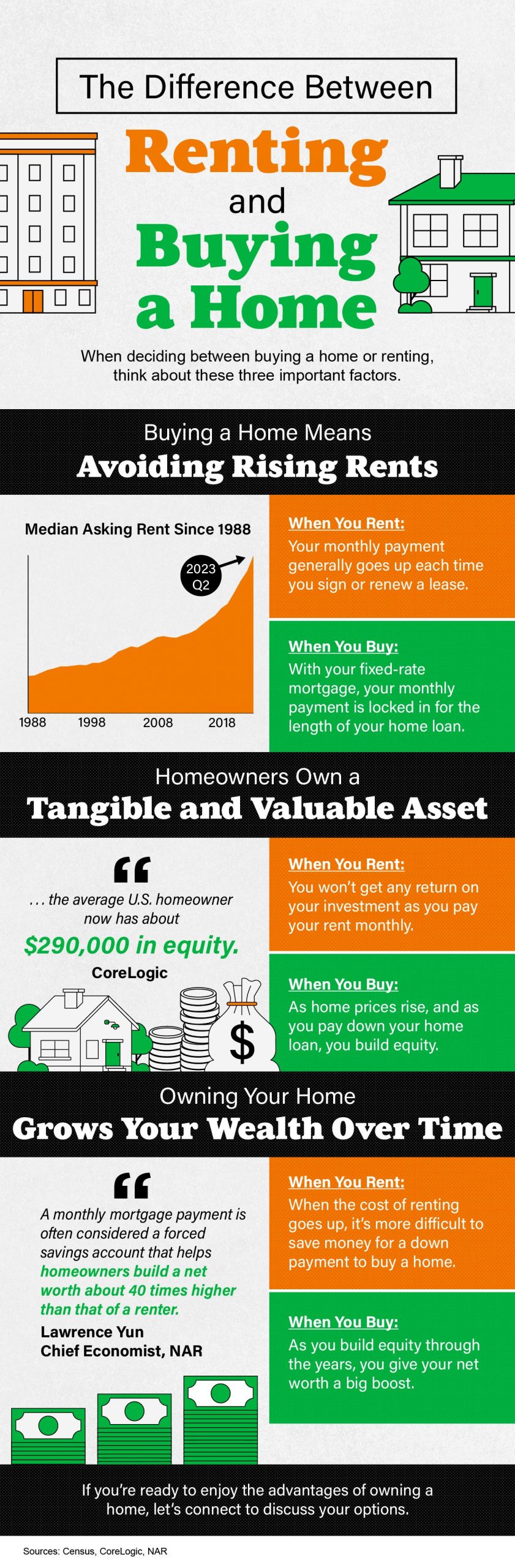

If you’re trying to decide whether to rent or buy a home, you’re probably weighing a few different factors. The financial benefits of homeownership might be one of the reasons you want to make a purchase if you’re a renter, but the decision can also be motivated by having a place that’s uniquely your own. If you want to express yourself by upgrading and customizing your living space but are feeling held back by your rental agreement, it might be time to consider the perks of owning your home.

A Little Change Can Bring Lots of Joy

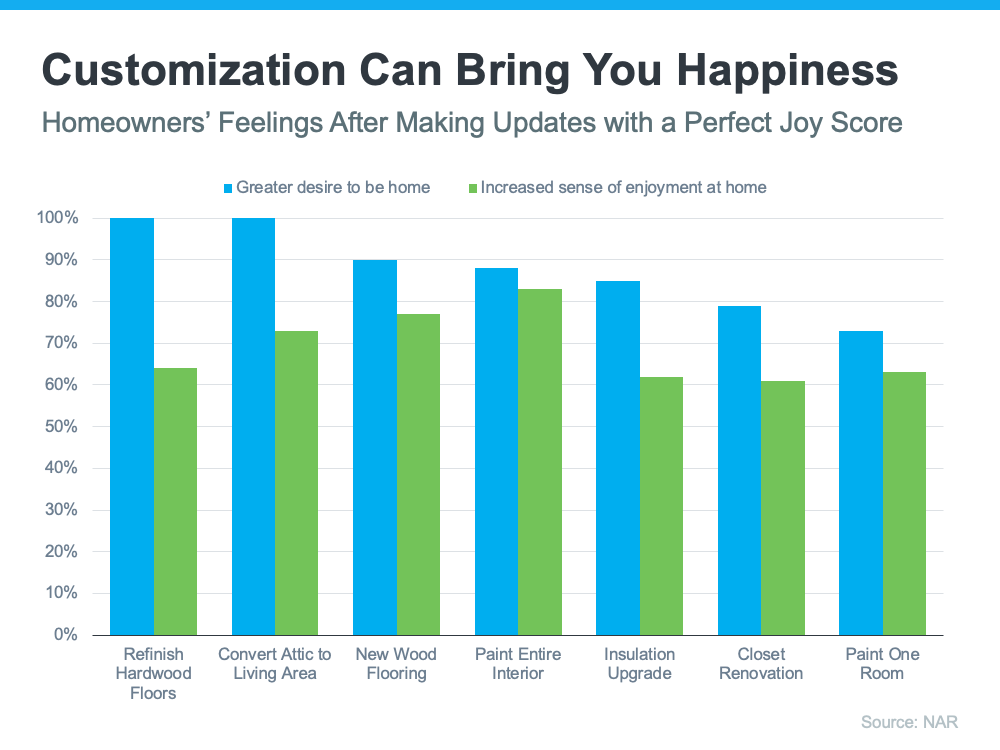

There’s a significant level of pride that comes from owning a home. That’s because it’s a space that truly belongs to you. A recent report from the National Association of Realtors (NAR) shows making updates or remodeling your home can help you feel more at ease and comfortable in your living space. NAR measures this with a Joy Score that indicates how much happiness specific home upgrades bring. According to NAR:

“There were numerous interior projects that received a perfect Joy Score of 10: paint entire interior of home, paint one room of home, add a new home office, hardwood flooring refinish, new wood flooring, closet renovation, insulation upgrade, and attic conversion to living area.”

The report also breaks down just how much each of these projects can enhance your emotional attachment to your home, even leading you to want to spend even more time in the space (see graph below):  And while many of the items NAR highlights are larger tasks, some, like painting rooms, are much smaller. Even those quicker projects can still bring you a greater sense of joy and accomplishment. Not to mention when you make upgrades in your home, you could be increasing its value which also gives your net worth a boost if you invest your time and effort wisely.

And while many of the items NAR highlights are larger tasks, some, like painting rooms, are much smaller. Even those quicker projects can still bring you a greater sense of joy and accomplishment. Not to mention when you make upgrades in your home, you could be increasing its value which also gives your net worth a boost if you invest your time and effort wisely.

You’re Free To Update Your Home to Your Heart’s Content

These types of updates can result in additional happiness when you complete them, but there’s another reason you can feel good as a homeowner. In most situations, you’re free to renovate or update the interior of your home without needing additional permission. But as Business Insider points out, renters may not have the same freedom:

“Your landlord won’t always approve changes when you rent. But you have the power to update the home when you’re the owner. (Just make sure any big changes are approved by your homeowner’s association, if necessary.)”

If you do make changes as a renter, there’s a good chance you’ll need to revert them back at the end of your lease based on your rental agreement. That can add additional costs when you move out. That’s one major benefit of owning your own home. Unless there are specific homeowner’s association requirements, you typically won’t have to worry about the changes you can and can’t make.

Bottom Line

Deciding whether to rent or buy is a personal decision. The financial benefits are critical, but don’t overlook the emotional impact homeownership can have. Let’s connect to discuss all the benefits you can enjoy when you purchase your own home.

Bottom Line

Deciding whether to rent or buy is a personal decision. The financial benefits are critical, but don’t overlook the emotional impact homeownership can have. Let’s connect to discuss all the benefits you can enjoy when you purchase your own home.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link